Anomaly detection solution for mobile banking

Guardian Analytics announced FraudMAP Mobile, the company’s latest fraud prevention innovation, purpose-built to identify suspicious mobile banking activity.

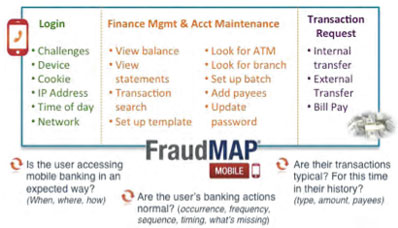

The solution uses anomaly detection across the triple play of mobile banking- SMS, mobile Web and mobile applications – to provide a critical layer of security that protects financial institutions and their mobile banking users. It also provides the anomaly detection capabilities expected by the FFIEC for all electronic banking channels.

Cybercriminals are escalating their attacks on mobile phones using SMS messaging, malicious mobile applications disguised as legitimate application, and criminal-controlled Wi-Fi networks. Experts predict their activity will increase in 2012.

FraudMAP Mobile provides financial institutions with an advanced and effective approach to protecting mobile and tablet banking users. Built using the same behavioral analytics that protects online account holders at over 150 financial institutions, it is the first anomaly detection solution purpose-built for the mobile banking channel.

It proactively alerts financial institutions to suspicious mobile behavior across all mobile experiences, including SMS banking, mobile Web banking and downloadable mobile applications.

The solution provides the following:

- A layer of security separate from the device providing transparent monitoring and analysis of all mobile banking activity for all mobile users;

- In-depth analysis of mobile banking activity to develop a mobile-specific behavioral model unique to each mobile banking user;

- Rich mobile banking activity history critical for understanding mobile risks, mobile adoption and mobile usage;

- Link analysis to proactively identify multiple accounts at risk; and

- Support for mobile banking platforms integrated with online banking platforms as well as standalone mobile platforms.

“The rise of mobile banking introduces a whole new set of security issues for financial institutions and their customers,” said Julie McNelley, research director in the Retail Banking Practice at Aite Group. “A mobile phone in the hands of a criminal provides them with access to all of the victim’s personal information that can not only lead to mobile banking fraud, but fraud in other channels as well as identity theft. To prevent this from happening, banks can’t rely on the device for security – they need to proactively prevent fraud before it occurs.”