Most organizations have already migrated to a cloud VPN

The majority of organizations have already migrated their VPN solution to the cloud, a NetMotion survey reveals.

A study surveyed 750 leaders working in IT, security and networking, polling leaders across five geographical markets and eight sectors. This audience shared their insights, familiarity and experiences with SASE and other network security topics.

Key findings

- 54% of organizations have shifted their remote access solution (VPN) from on-premise to the cloud. This includes VPN products hosted as SaaS offerings or those managed in the private cloud (IaaS), such as Microsoft Azure or AWS.

- Australian (62%) and American (60%) organizations are leading the charge to cloud enterprise VPNs, with Japanese (46%), British (50%) and German (52%) businesses slower to migrate.

- Government and public safety bodies are more apprehensive about adopting cloud-hosted VPN products, with only 29% of organizations in these sectors making use of a cloud VPN. Companies in the healthcare (72%), manufacturing (68%) and legal (56%) markets were the most likely to be utilizing a cloud VPN.

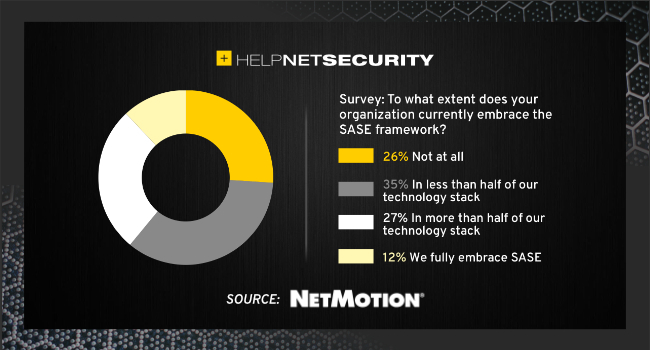

- Adoption of cloud-first solutions is partly being driven by SASE initiatives. 74% of organizations have started to embrace the SASE framework in managing network security in the cloud and at the edge, with only 26% having no plans at all.

- 50.2% of organizations have migrated at least half of their core applications to the cloud. A higher proportion of American firms (52%) have reached this milestone than in other markets surveyed, while British firms (46%) lag slightly behind.

VPNs and SWGs: The most popular forms of cloud security products

The study showed that VPNs and SWGs are the most popular forms of cloud security products inside most organizations, perhaps as a result of their relative maturity. It appears that modernizing existing technologies (VPN, firewall, SWG) is more attractive to IT leaders than the adoption of new categories (CASB, ZTNA, edge content filtering).

Adoption of CASB (16%) and ZTNA (15%) is still low. These nascent markets are growing fast but are today mostly used by innovative companies rather than the mainstream. ZTNA adoption is consistent across verticals and markets, at 12-18% in all five markets included in this study.

Filtering content at the edge is most prevalent in the US (23%), perhaps driven by the need to ensure compliance and security amidst the growth in remote working. This is compared to a global average across other markets of just 13%.

SASE networking solutions are less likely to have been implemented than security solutions, on average. Researched showed that there is no network technology category present in over half of organizations surveyed.

Over a quarter of organizations are now taking advantage of SD-WAN, a fast-growing category of network solutions. German companies are using SD-WAN products more than those in other markets, with 38% of respondents including it in their network stack, compared with a global average of 25% – only 19% of Japanese firms are currently using it.