Zumigo deRiskify verifies mobile and payment card ownership identity for all transactions

Zumigo released deRiskify, an application on the Shopify Platform to help merchants detect fraud from online purchases made by consumers.

The online eCommerce industry has seen fraud increase significantly every year. With today’s launch, merchants can now seamlessly install Zumigo’s new unique tool to detect fraud from online purchases made by consumers on the Shopify platform. This unique fraud tool verifies mobile and payment card ownership identity for all transactions, empowering merchants to take control of their costs and chargebacks, while reducing fraud risk.

“SCOOTY is a leading micro-mobility company that provides the public with affordable, simple access to electric scooters and bikes,” said Shoaib Ahmed, SCOOTY’s Founder and CEO. “We are an established merchant selling on Shopify, and after implementing the Zumigo deRiskify system we have recorded successful sales and are now able to assess the quality of the transactions. I wish we had deRiskify when we started!”

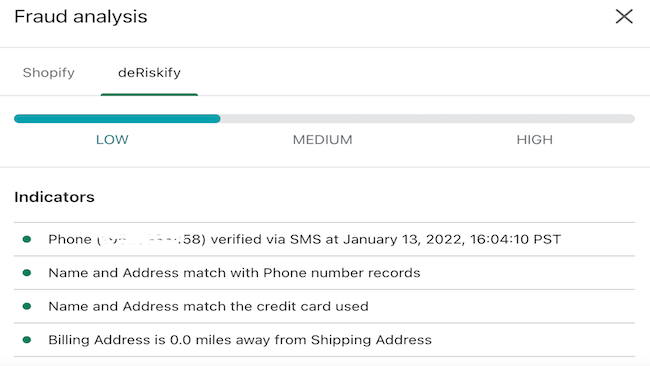

deRiskify provides critical order risk indicators in real-time, allowing merchants to verify if an order was placed by a genuine customer by verifying identity across multiple vectors, including authoritative name and address matching to a mobile number, physical mobile possession confirmation, mobile proximity, name and address matching to a credit card, and other velocity-based indicators to flag potential fraud in eCommerce orders. Using the order risk indicators provided by deRiskify, merchants can now fulfill orders quickly with increased confidence of a genuine customer, reduced fraud and lower chargeback risk.

deRiskify extends Zumigo’s phone identity capabilities to online consumer purchases made on the common standard Shopify platform, and is available to all merchants in an easy plug-and-play wizard without months of integration required by other online fraud solutions. deRiskify is not based on online consumer behavior, purchase patterns or other fuzzy techniques which can lead to significant fraud, false positives and chargebacks. Instead, deRiskify utilizes multiple authoritative techniques, making it more accurate in detecting fraud and eliminating false positives.

“deRiskify is a unique solution for the industry that equips merchants with more accurate online fraud detection capabilities and allows them to generate more eCommerce revenue while reducing their risks,” said Chirag Bakshi, Zumigo CEO and Founder. “Protecting consumer mobile identity is the core principle and business of Zumigo. Our customers turn to us because billions of dollars are at stake due to fraudulent online purchases.”

As a leading mobile identity data provider protecting more than 120 million consumers from online account fraud, Zumigo has been working with major financial institutions and eCommerce retailers for the past number of years to protect their customers and accounts by adding an extra layer of identity protection and verification through their mobile phone numbers.

Zumigo’s global identity SaaS platform is a cloud-based service that integrates with merchants’ processing systems, in this case the Shopify Platform, to verify users’ identity to prevent fraud. Discrepancies in mobile phone and account information are quickly flagged, saving Zumigo customers significant expenses from fraudulent account creation with stolen or synthetic IDs, and wire or other payment fraud. Zumigo’s identity verification solutions validate the true identity of the mobile user and their ownership of credit cards presented for online purchases.