Will security concerns negatively impact the online holiday shopping season?

In a survey of over 1,900 consumers crossing the US and UK, Computop found 76 percent planned to shop online this holiday season. However, 62 percent of those respondents overall don’t plan to shop on Cyber Monday.

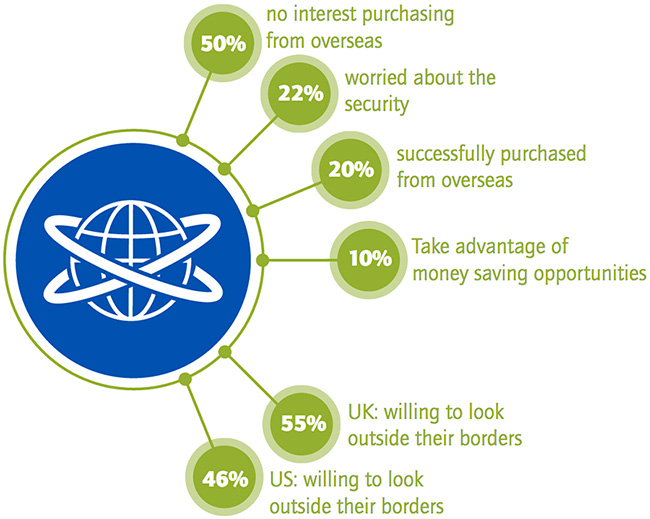

When asked about purchasing products online from retailers outside of their own country this holiday season, 50 percent of respondents said they were not interested in doing this as they have enough options domestically. An additional 22 percent noted that they were concerned about the security of their payment data beyond their borders.

The statistics above may point to a broader uncertainty about the safety and security of consumers’ payment information online.

Security concerns

- When asked whether they are concerned about security when disclosing their credit card and bank information online, 74 percent of respondents overall agreed, with 45 percent of those strongly agreeing.

- When shopping online, 71 percent of consumers confirmed that they check if the site has certificates like eTrust and SSL Certificate from Verisign, with 42 percent strongly agreeing that they do this.

- In addition, 61 percent of shoppers confirmed that they have checked the liability policy of their preferred payment method provider or bank in the case of fraud.

- When it comes to shopping at retailers that have recently experienced a data breach, more than half of respondents, 57 percent in total, agree that they would not shop with them, with almost a third, 31 percent, stating that they strongly agree that they would avoid that retailer.

- While consumers have these security concerns, they aren’t necessarily interested in changing their behaviours to protect themselves. For example, when shopping online, consumers can opt to use retailers that offer in-store payments so they don’t have to disclose their financial information. Despite this, 41 percent of respondents indicated that they prefer not to. Also, when respondents were asked if they prefer to browse online and purchase in-store, again avoiding the need to submit financial details, 38 percent did not agree with doing this.

- In addition, 51 percent of respondents confirmed that they did not have an insurance epolicy protecting them from liability in the case of credit card and/or banking fraud.

Payment preferences

- Trusted payment methods differed slightly between U.S. and UK respondents with regards to shopping online. In the U.S., 59 percent trust their credit card most, with 35 percent opting for PayPal and 27 percent choosing their debit card.

- UK consumers trust PayPal more, with 50 percent selecting this option, followed by credit card (38 percent) and debit card (33 percent).

Security authentication

- When asked which security authentication features respondents would consider setting up for online purchases in the next 12 months, 35 percent said they would set up fingerprint IDs, 12 percent selected retina scans, 7 percent chose voice recognition and 2 percent noted pay-by-selfie – but 41 percent of total respondents said they wouldn’t choose any of the above.

- 26 percent of respondents are concerned that their biometric data could be spoofed, and 11 percent do not trust biometric data for payment authentication.

- 30 percent prefer their banking PIN and TAN to authenticate their payments.

- Only 19 percent of consumers surveyed felt that the benefits far outweigh the security risks when it comes to sharing their biometric data for payment authentication.

“It’s not surprising to see the online shopping trend expected to continue this holiday season,” said Ralf Gladis, CEO of Computop. “What was particularly interesting is that despite the sustained interest in purchasing online, consumers continue to have significant concerns about the security of their personal information. However, they are not necessarily interested in taking extra steps to protect themselves – and in the case of the newer authentication technologies we agree. Before moving forward with features like these, it’s critical as an industry that we are able to ensure this data is stored securely before we potentially open up a possible new area for identify theft.”